Jan 20, 2010

I've realized that the "IP Market Player of the Week" may also be a highly influential individual in the IP market, and should not be limited to firms and institutions. Thus, this week's "IP Market Player of the Week" is an individual working from within a large institution.

The position of IP asset manager is not one which is commonly held by the largest I-Banking institutions across the world. Nevertheless, Deutsche Bank, and more specifically one of its Directors, Marc Lucier, have formed ... Read More

Dec 18, 2009

The Intellectual Property Exchange International (IPXI) has announced that it has hired a new President, Gerard J. Pannekoek. This looks promising for IPXI, as Pannekoek was the former President and COO of the Chicago Climate Exchange (CCX), the world's first multi-national and multi-sector exchange for reducing and trading greenhouse gas emissions. His leadership there led to a successful IPO within twelve months of his employment.

The Intellectual Property Exchange International explains itself as follows:

The Intellectual Property Exchange International provides an innovative approach to ... Read More

Aug 13, 2009

For publicly traded IP-rich companies, the correlation between the strength of an IP management and protection plan and stock price is obvious. The track record of the OT 300 pitted against the S&P 500 between 2006 and November 2008 shows this clearly. The OT 300 outperformed the S&P 500 by just over 460 basis points.

We keep talking about the absence of IP value from corporate balance sheets. It just may be this absence, in fact, that tends to push such IP-rich companies' stocks ... Read More

Jul 16, 2009

A great article in the New York Times today focused on university technology transfer efforts and venture funding for start-up companies in the nanotechnology field. Besides opening some eyes to the various beneficial uses of nanotechnology, the article explains the angel and VC investors that join forces with universities in subsidizing new companies, whether that be through start-up capital or providing the machines necessary to produce these technologies. Nanotech companies frequently own one type of asset and one type of asset only: ... Read More

May 18, 2009

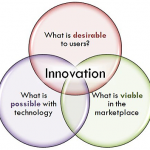

When the line of traditional investment opportunities curtails, creative alternative investments must be found. I like to think that, currently, one of the most creative alternative investments that provides an option for great return (but with significant risk) can be found in commercial-stage intellectual property. Investing in inventors, universities, and start-ups involved in the innovation-to-commercialization process offer a unique but catchy investment opportunity, and Paul Capital has taken note.

The self-proclaimed "alternative investment firm" offers a branch that focuses on financing royalty products, ... Read More

May 8, 2009

The economic storm in which companies have found themselves has brought cost-cutting measures to every C-suite discussion table. Frequently, one of the first costs to go is the one which is associated with the most risk, R&D. However, as a recent BusinessWeek article points out, this may just be the time to increase innovative practices instead of cutting them. The best quote comes from Samuel Palmisano, the Chief Executive of IBM:

"Some may be tempted to hunker down, to scale back their investment in ... Read More

Feb 27, 2009

There is a discreet lending market in New York and few places beyond that trades cash for copyrights until the cash is returned with interest. To play in this field might actually be less of a risk than banks lending on collateralized real estate, based on the fluctuation of real estate values. Certain and valuable copyrights hold their value quite nicely, even in a recession.

A recent story in the New York Times (which also reached a few IP blogs such as IPKat) disclosed ... Read More

Feb 22, 2009

PatentFreedom is a full service establishment offering subscription-based assistance in fighting the threat of non-practicing entities (NPE's). NPE's are a growing threat to operating companies with patent portfolios of their own, in that NPE's don't hold their patents for core operational purposes, but instead use strategic enforcement activities such as licensing and litigation to turn a profit. This use of patents has grown into a threatening phenomenon in the technology industries at an alarming rate. PatentFreedom sets out to educate operating companies ... Read More

Feb 16, 2009

Last week, a landmark decision in a Patent Court in England finally broke ground for employee inventors in the UK trying to receive royalties for their inventions' added value. The case, Kelly and Chiu v GE Healthcare Ltd [2009] EWHC 181 (Pat), enforced provisions of UK patent law that had been introduced over thirty years ago and amended recently to add teeth. Specifically, the provision provides for employee inventors to receive compensation for a patent's added benefit to corporate value. As IPKat reports, the decision ... Read More

Feb 12, 2009

This week's IP Market Player is Royalty Pharma. The name has begun to pop up in articles and conversations regarding attractive alternatives to raising equity capital. In a nutshell, the company purchases royalty interests in biopharmaceutical products and late-stage development drugs. Through careful purchases, it provides liquidity to its shareholders investing in these royalty streams while assuming the risks of ownership in this IP. This is an innovative product driven method of financing that is somewhat shielded from market volatility and stock price ... Read More

Ian McClure is a former corporate & securities and intellectual property law attorney with

Ian McClure is a former corporate & securities and intellectual property law attorney with  Trevor M. Blum is a former Associate in the Chicago-based, valuation practice group of Ocean Tomo, LLC., an intellectual property (IP) consultancy. Additionally, he provided instrumental research support to Intellectual Property Exchange International, Inc., an IP exchange start-up. Trevor holds a B.S. from Indiana University and is currently an MBA candidate at the University of Cambridge, focusing on international business and finance. His interests also include entrepreneurship, economics, and informational visualization. He enjoys running and cycling in his free time. Trevor seeks to bring a transnational business perspective to the blog.

Trevor M. Blum is a former Associate in the Chicago-based, valuation practice group of Ocean Tomo, LLC., an intellectual property (IP) consultancy. Additionally, he provided instrumental research support to Intellectual Property Exchange International, Inc., an IP exchange start-up. Trevor holds a B.S. from Indiana University and is currently an MBA candidate at the University of Cambridge, focusing on international business and finance. His interests also include entrepreneurship, economics, and informational visualization. He enjoys running and cycling in his free time. Trevor seeks to bring a transnational business perspective to the blog.