The economic storm in which companies have found themselves has brought cost-cutting measures to every C-suite discussion table. Frequently, one of the first costs to go is the one which is associated with the most risk, R&D. However, as a recent BusinessWeek article points out, this may just be the time to increase innovative practices instead of cutting them. The best quote comes from Samuel Palmisano, the Chief Executive of IBM:

The economic storm in which companies have found themselves has brought cost-cutting measures to every C-suite discussion table. Frequently, one of the first costs to go is the one which is associated with the most risk, R&D. However, as a recent BusinessWeek article points out, this may just be the time to increase innovative practices instead of cutting them. The best quote comes from Samuel Palmisano, the Chief Executive of IBM:

“Some may be tempted to hunker down, to scale back their investment in innovation . . . [w]hile that might make sense during a cyclical downturn, it’s a mistake when you’re going through a major shift in the global economy.”

This is an interesting position, for as the economy shifts in such a dramatic way, so do market shares, and R&D is the best way to capitalize on available market share. The article goes on:

In an annual survey of top executives by Boston Consulting Group (BCG), which provides the foundation of BusinessWeek’s 25 Most Innovative Companies list, more respondents said that innovation spending will be flat or down than since the ranking began in 2005.

This is also interesting, because licensing practices have grown substantially in the last 8 years - licensing revenue in the U.S. has grown by almost $400 billion. Does this mean that inbound licensing and participation in licensing pools is taking the place of traditional innovation efforts? Possibly.

One more quote from the article caught my eye. Speaking about Apple’s recent innovative efforts, a respondent to the above-mentioned survey stated:

“Their products are improvements on previous technology. Their execution is flawless, but they are not necessarily innovative.”

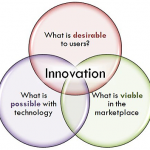

My reaction: why is improving previous technology not innovation? To create completely new technology is to invent, not innovate. It can be argued that there is truly no completely original invention, as all inventions are improvements upon previous technology. This leads back into the relationship between licensing and innovation, because licensing practices are used to avail oneself of other technologies in order to improve or use your own technologies. In this light, licensing assists innovation, and creates a bridge between exclusivity and creation.

I believe that Mr. Palmisano and the IBM team may have it correct. A shift in the economy is a time to reclaim, or newly claim, market shares. Those corners of the market that were steadfast in the grip of one or a few companies before last fall are now up in the air. This is a time to invest in reinvention. To take a great quote from a recent article in the last issue of IAM, written by John Cronin and Bruce A Story of ipCapital Group:

“Viewing IP costs as expenses rather than as investments in protecting the vital innovation of the corporation can be shortsighted.”

Ian McClure is a former corporate & securities and intellectual property law attorney with

Ian McClure is a former corporate & securities and intellectual property law attorney with  Trevor M. Blum is a former Associate in the Chicago-based, valuation practice group of Ocean Tomo, LLC., an intellectual property (IP) consultancy. Additionally, he provided instrumental research support to Intellectual Property Exchange International, Inc., an IP exchange start-up. Trevor holds a B.S. from Indiana University and is currently an MBA candidate at the University of Cambridge, focusing on international business and finance. His interests also include entrepreneurship, economics, and informational visualization. He enjoys running and cycling in his free time. Trevor seeks to bring a transnational business perspective to the blog.

Trevor M. Blum is a former Associate in the Chicago-based, valuation practice group of Ocean Tomo, LLC., an intellectual property (IP) consultancy. Additionally, he provided instrumental research support to Intellectual Property Exchange International, Inc., an IP exchange start-up. Trevor holds a B.S. from Indiana University and is currently an MBA candidate at the University of Cambridge, focusing on international business and finance. His interests also include entrepreneurship, economics, and informational visualization. He enjoys running and cycling in his free time. Trevor seeks to bring a transnational business perspective to the blog.

No Comments, Comment or Ping

Reply to “Innovation as an Investment, Not an Expense”