Dec 15, 2009

In the corporate world, the phrase "due diligence" is generally used in the same sentence as the word "merger" or "acquisition", and quite rightly so. Due diligence is the practice of "fact-checking" the representations and warranties set forth in the acquisition documents and/or purchase agreement. It is also a diligent investigation of the acquisition target to make sure no sleeping liabilities are left under the covers.

But due diligence is not inextricably tied to the M&A process. In fact, it should be a ... Read More

Oct 13, 2009

I have posted previously on the continued discussions by the United Nations Commission on International Trade Law (UNCITRAL) Working Group VI (Security Interests) regarding issues in intellectual property that are raised by the inconsistencies between intellectual property law and secured transactions law. These issues have become the focal point for this Group as they attempt to put together an IP addendum to the Legislative Guide on Secured Transactions, which is to be adopted by member states.

IP Finance has kept up with the ... Read More

Jul 14, 2009

Could this be a resurgence of IP securitization? Financial Times has reported a large IP securitization deal worth $250M executed by Morgan Stanley with Vertex Pharmaceuticals. Investors' return will be based on milestone royalty payments received from sales of a drug that hasn't even been approved yet. Before the recession, securitizing intangibles was becoming somewhat popular. Many are aware of the Dunkin Donuts deal that hit headlines everywhere. Still, these deals, along with most other deals, have dried up. The Vertex deal shows ... Read More

May 27, 2009

The Chicago Tribune reported today that Facebook will be getting a $200 Million investment from Digital Sky Technologies, a Russian firm. The investment is said to be in exchange for almost 2% of Facebook's stock, valuing the California-based internet social networking site at roughly $10 Billion. This is down from the $15 Billion valuation of the company represented by the $240 Million investment Facebook received from Microsoft for a 1.6% stake in the company, but it grossly exaggerates the $3.7 Billion valuation Facebook ... Read More

May 12, 2009

The rising tide of the recession has brought with it a wave of change in our approach to commerce, but perhaps no transition has provided as much optimism as the growing share of commerce involving intellectual property assets. Intellectual property has been increasingly recognized as a burgeoning asset class, an important financing tool, and a revenue-generating instrument for exchange. Acknowledging this phenomenon, the United States has joined a global initiative to help push a common knowledge of this use of intellectual property, ... Read More

May 8, 2009

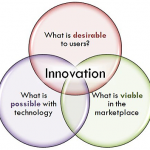

The economic storm in which companies have found themselves has brought cost-cutting measures to every C-suite discussion table. Frequently, one of the first costs to go is the one which is associated with the most risk, R&D. However, as a recent BusinessWeek article points out, this may just be the time to increase innovative practices instead of cutting them. The best quote comes from Samuel Palmisano, the Chief Executive of IBM:

"Some may be tempted to hunker down, to scale back their investment in ... Read More

Apr 24, 2009

The discussion continues on the IP valuation front. Joff Wild added a reader response to his original "myth buster" post regarding IP valuation myths. The response is written by Nir Kossovsky, executive secretary of the Intangible Asset Finance Society and CEO of Steel City Re. The relevant part reads:

Our current markets are volatile because value is uncertain. International accounting standards suggest that all assets be valued at market. There is considerable push back in the US because the market is damaged and ... Read More

Apr 21, 2009

The newest Intellectual Asset Management Magazine (IAM) revisits what is probably the most important, and most troubling, issue pervading the IP market today: Intellectual property valuation. I have visited the topic in a number of posts, and this trend probably won't stop anytime soon. The IAM article is another step in the right direction, authored by Pat Sullivan, who has taken the reigns on the conversation of standard setting in IP valuation.

While I encourage everyone to find this issue of IAM, if not every issue, I understand it ... Read More

Apr 9, 2009

As individuals and small businesses look to secure funding during a credit freeze, finance innovation has led to a jump in IP-based funding. In 1997, David Bowie opened eyes when he issued asset-backed bonds on the basis of future royalties, raising over $55 million. This year, Annie Leibovitz, the famed photographer for Rolling Stone and Vanity Fair, secured $16 million in loans by pledging her life's work of copyrights. The practice is not exclusively available for stars, however, as companies are turning ... Read More

Mar 31, 2009

I returned from the Ocean Tomo Spring 2009 Conference and Auction in San Francisco with a head full of questions about the status of the market. The market continues to grow, and that is a fact evidenced by the number of professionals and market participants that attended the conference. Nevermind the dismal auction results, which will be the subject of another post, the conference itself and the overall optimistic and enthusiastic mood of discussion that buzzed through the rooms and halls of ... Read More

Ian McClure is a former corporate & securities and intellectual property law attorney with

Ian McClure is a former corporate & securities and intellectual property law attorney with  Trevor M. Blum is a former Associate in the Chicago-based, valuation practice group of Ocean Tomo, LLC., an intellectual property (IP) consultancy. Additionally, he provided instrumental research support to Intellectual Property Exchange International, Inc., an IP exchange start-up. Trevor holds a B.S. from Indiana University and is currently an MBA candidate at the University of Cambridge, focusing on international business and finance. His interests also include entrepreneurship, economics, and informational visualization. He enjoys running and cycling in his free time. Trevor seeks to bring a transnational business perspective to the blog.

Trevor M. Blum is a former Associate in the Chicago-based, valuation practice group of Ocean Tomo, LLC., an intellectual property (IP) consultancy. Additionally, he provided instrumental research support to Intellectual Property Exchange International, Inc., an IP exchange start-up. Trevor holds a B.S. from Indiana University and is currently an MBA candidate at the University of Cambridge, focusing on international business and finance. His interests also include entrepreneurship, economics, and informational visualization. He enjoys running and cycling in his free time. Trevor seeks to bring a transnational business perspective to the blog.